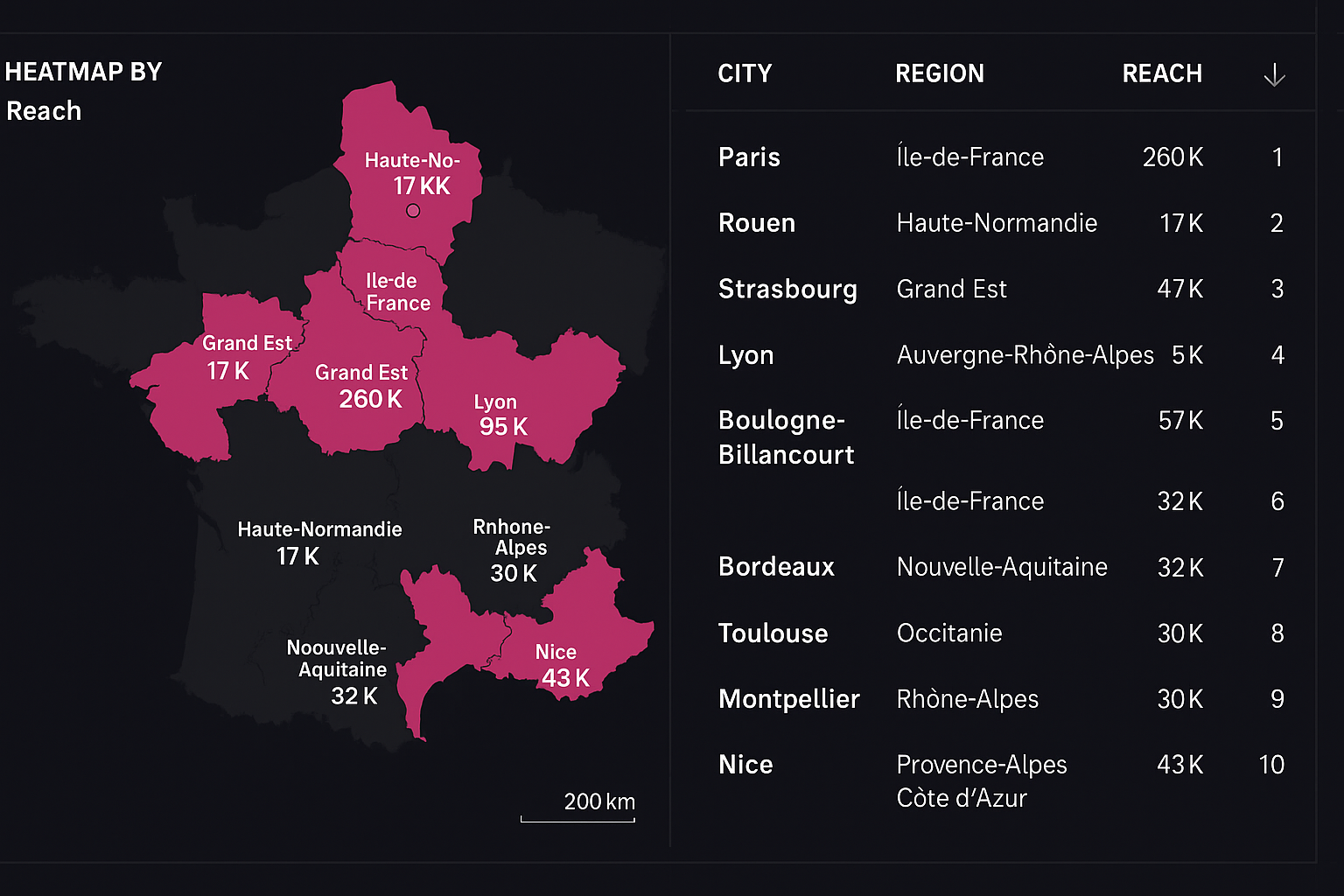

Size your potential markets with data-driven precision

No more guessing or relying on outdated reports. Rascasse uses digital behavioral signals—search queries, content engagement, platform activity—to quantify how many people are genuinely interested in a product, category, or theme. You can explore market potential in real time, down to the city or even zip code, across 160+ countries. Whether you’re evaluating a niche segment or a mass-market trend, Rascasse reveals actual demand, not just hypothetical interest.

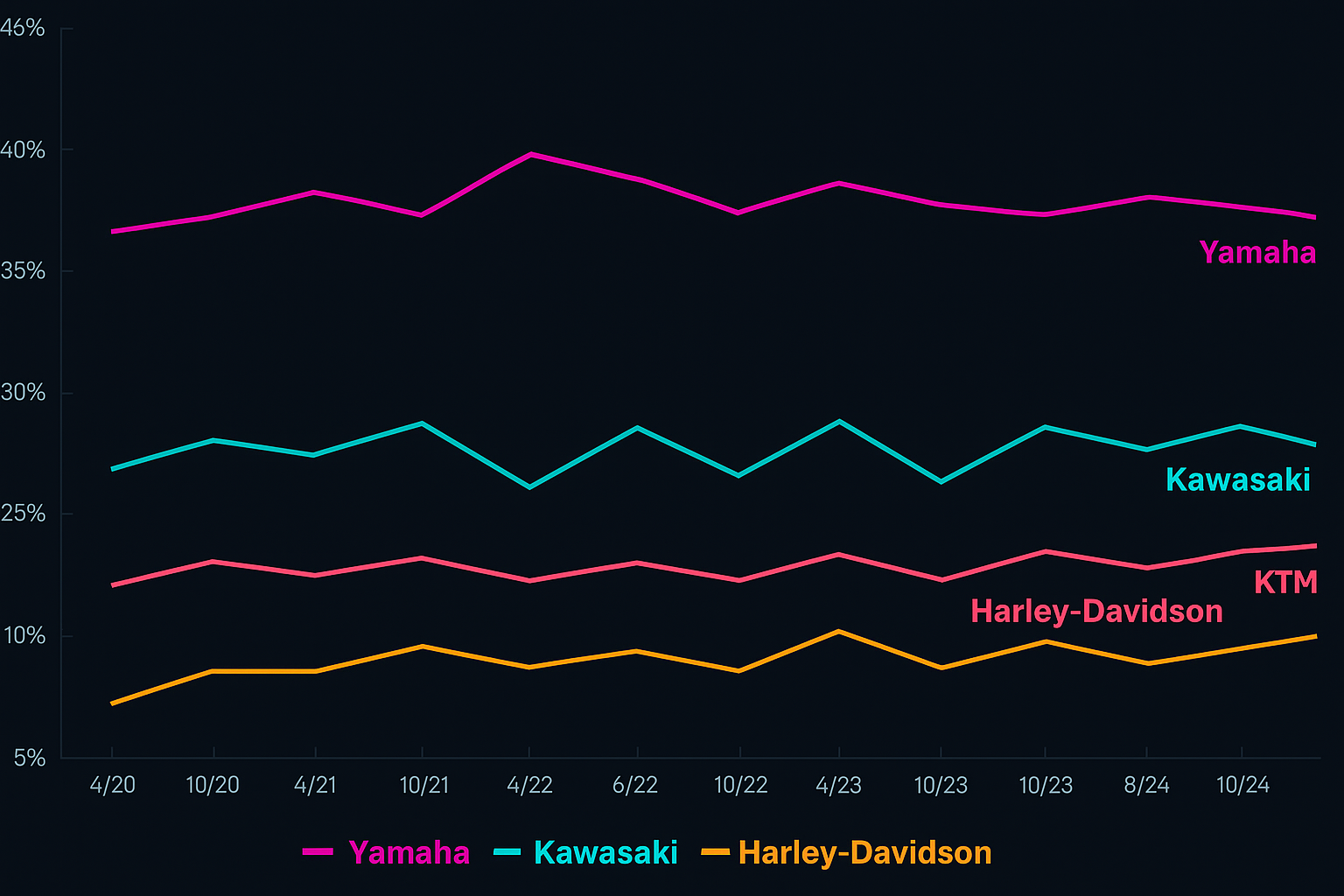

Monitor and optimize your Share of Interest

Track how your brand’s visibility and relevance evolve over time using our “Share of Interest” metric—a behavioral alternative to traditional brand awareness surveys. This shows how your brand performs compared to others in terms of engagement and attention across platforms. See where you’re gaining ground, where you’re falling behind, and which campaigns or sponsorships actually move the needle.

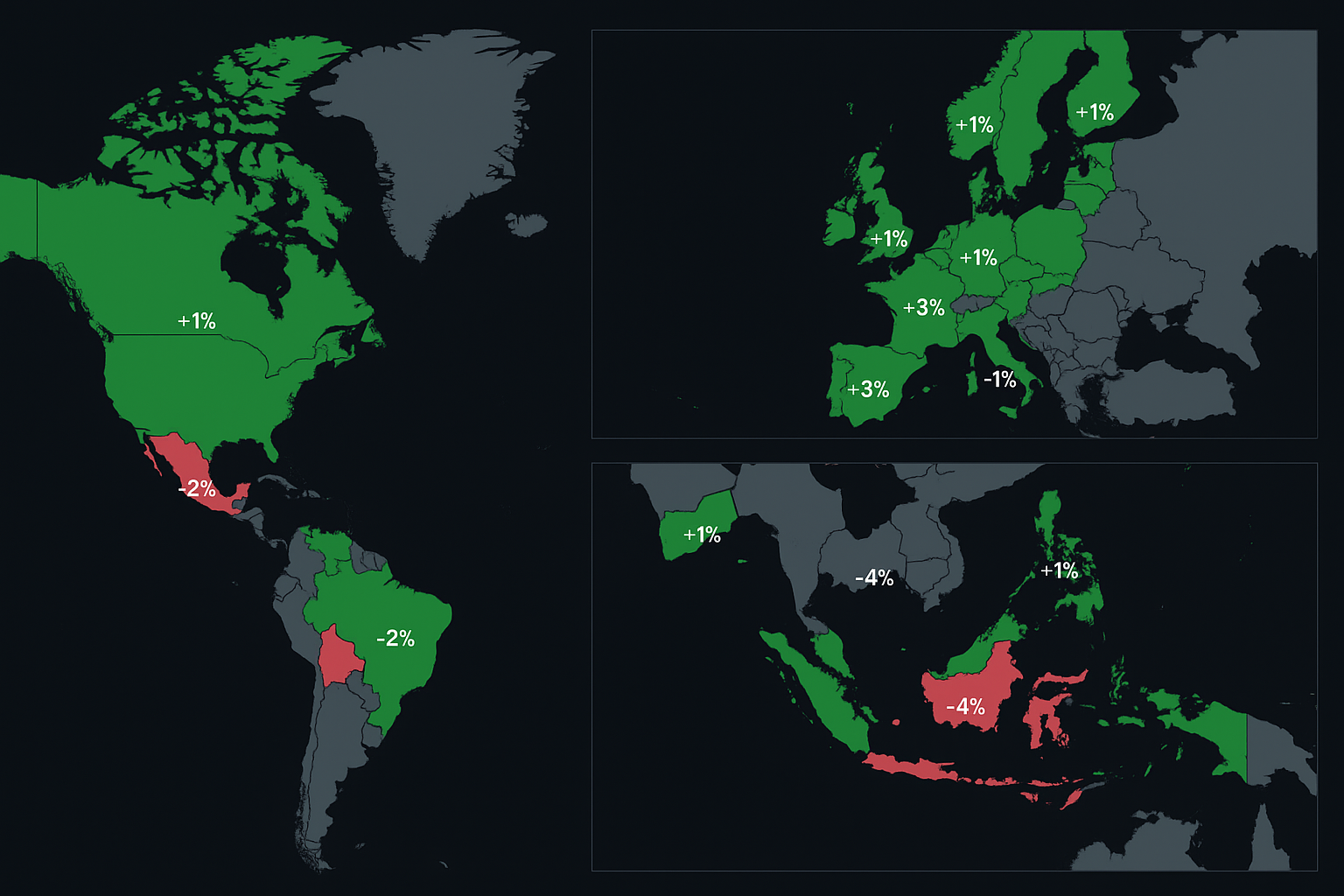

Benchmark brand visibility across regions

Understand how your brand is perceived in different geographies—whether you’re dominant in Munich, rising in Mexico City, or underperforming in Seoul. Compare visibility and engagement metrics across any market, industry, or competitor set. This lets you localize your marketing and investment strategy with precision: where to push, where to defend, and where to pivot.

Support global rollout and expansion planning

Entering a new market is always a strategic risk. Rascasse reduces that risk by providing solid, data-backed insights into demand, behavior, and competitive context. Identify high-interest regions before launching. Tailor your go-to-market plan based on local interests, media usage, and brand affinities. And measure early traction with KPIs that react in weeks—not quarters.